Good for your patients. Good for your business.

Health & Wellness comes first when you partner with Afterpay. Customers access the care they need, when they need it. You’ll get paid upfront, while they pay in instalments. That’s healthy business.

Health comes first when you partner with Afterpay. Patients access the healthcare they need, when they need it. You’ll get paid upfront while they pay in instalments. That’s healthy business.

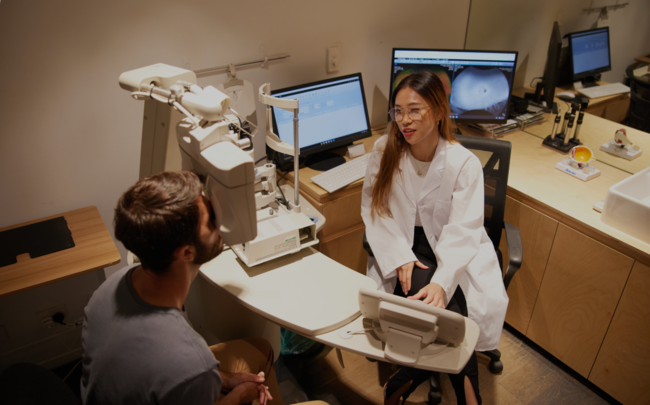

1 in 4

The number of Afterpay customers who currently use Afterpay for health and wellness services.1

The number of customers who say they would have looked for another provider if a business didn’t offer Afterpay.2

3.25

The average number of times Afterpay customers visit health and wellness providers each year.3

4m

The number of active customers across Australia & New Zealand.2

1. Source: Afterpay owned data.

2. Source: AlphaBeta Afterpay Analysis, March 2021.

3. Source: Afterpay FY21 presentation.

Good for your patients and customers.

They can:

Good for your business.

You can:

2. Source: Afterpay FY21 presentation

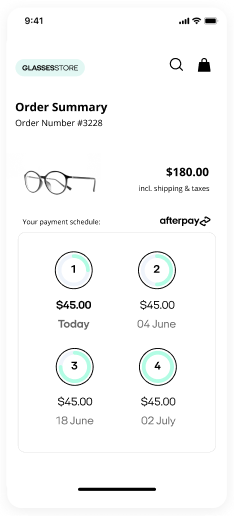

Your business is paid upfront. Your patients pay over time.

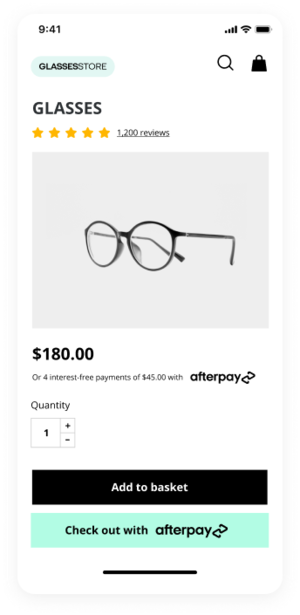

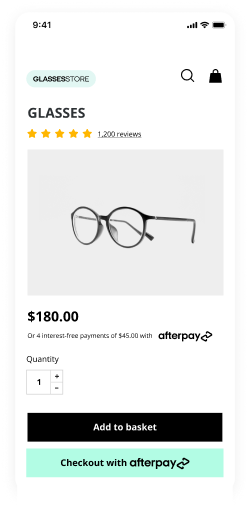

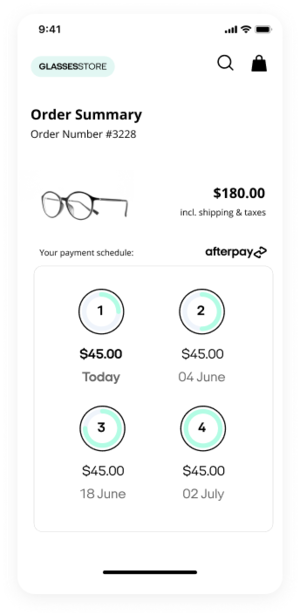

It’s easy for patients to use Afterpay, and just as easy for businesses to offer it. Patients pay in four instalments, while you, the merchant, get paid upfront.

Millions of Aussies and Kiwis use Afterpay. Does your business?

Discover what top health & wellness brands already know; Afterpay is good for patients, and good for business.

Frequently Asked Questions

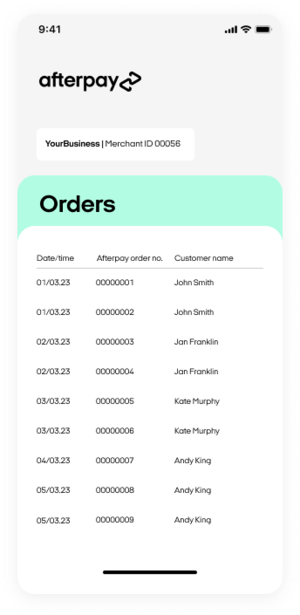

It’s easy to offer Afterpay both online and in-practice. Online, we have pre-built integrations with most common website platforms, and in-store we'll work with your existing POS terminal - no integration needed! Simply click here to get started with the sign-up process. We’ll ask you for some details, such as business name, ABN, and address. Then we’ll support you step-by-step through the process to start offering Afterpay.

Afterpay will only process refunds following the instruction by a merchant though the issue of a refund request via the Merchant Portal.

- Afterpay will adjust the patient's payment schedule accordingly to reflect the refund issued.

- Afterpay will process amounts back to the patient’s card in the instances where they have made payments to Afterpay already.

- An email will be sent from Afterpay to the patient to confirm the refund has been processed and communicate the changes to their payment schedule.

- Any refunds will be accounted for in the next settlement date. Refund amounts will be clearly identified as such in the detailed settlement information.

Yes. A patient can make use of their private health insurance to cover part of or reduce their total payment, and then utilise Afterpay to cover the remaining amount due.

Yes! Patients can pay for bulk packages or subscriptions using Afterpay. This helps patients by allowing them to access bulk rates and commit to long-term health solutions, and it helps business owners by increasing average order value.

Afterpay was founded on the belief that customers can respect their financial limits and independently manage their money. That’s why we offer smart spending limits. Every Afterpay customer starts with a spending limit of around $600, which increases gradually over time. As a newer customer, the first repayment is due upfront. The longer a customer has been a responsible spender with Afterpay – making all payments on time – the more likely the amount they can spend will increase.

Settlement days depend on a few different factors, including your merchant category, experience, and delivery time frames. As an Afterpay merchant, you’ll be assigned a settlement period of between 1-5 business days in your agreement with us, and we periodically review merchants on longer settlement periods to reduce this where possible.

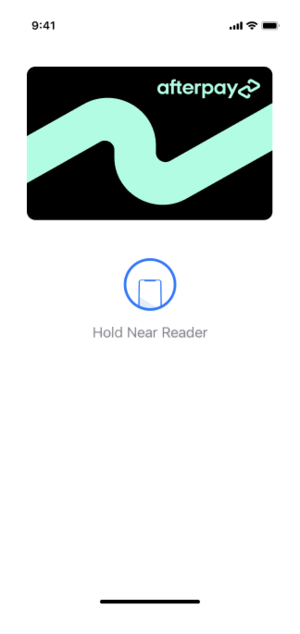

Patients can add Afterpay Card to their digital wallet by downloading the Afterpay app. Once set up, Afterpay Card is accessed through a patient’s digital wallet, just like any other digital card, as long as the merchant accepts Afterpay.

Yes! Afterpay can be used for purchasing products and services, including dental appointments, veterinarian services, physio appointments, and more.

The Afterpay Plus Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc,. and the installment plans under the Afterpay Plus Card are issued by First Electronic Bank, Member FDIC. Click here for complete terms.

Visa® is a registered trademark of Visa U.S.A Inc. All other trademarks and service marks belong to their respective owners.