Sign up via the Shop tab in the Afterpay app.

INTRODUCING THE AFTERPAY PLUS CARD

Pay it in 4 everywhere

Limited time offer! The first 25k users will get 50% off their first 6 months.**

Get the Afterpay Plus Card for $5.99 monthly to pay it in 4 in more places

Get the Afterpay Plus Card for $5.99 monthly to pay it in 4 in more places.

No hard credit check

Your credit score or rating won’t be affected when you apply for or use the Afterpay Plus Card.

Be the boss of your spends

Shop earn, and save

See Available Offers

Learn More

How it works

1. Get it

Sign up via the Shop tab in the Afterpay app.

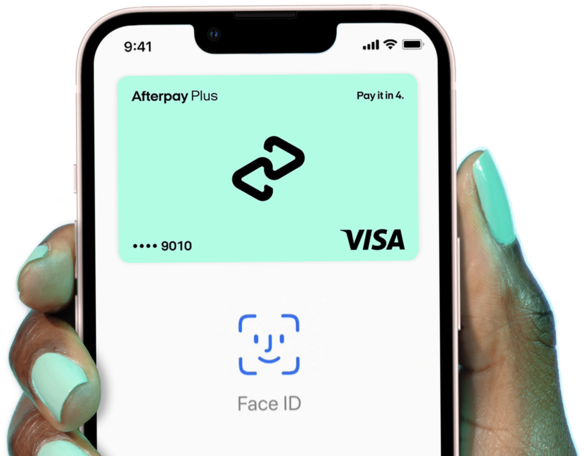

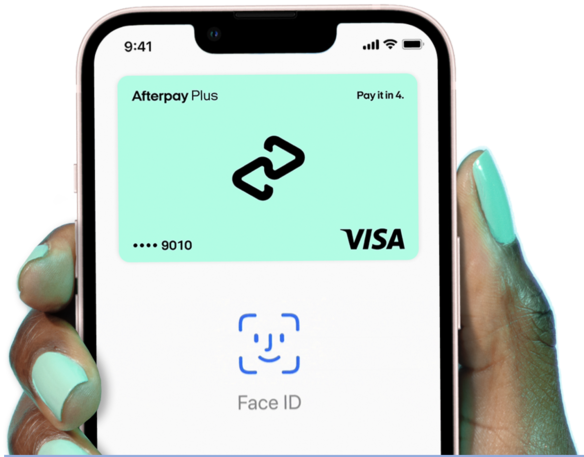

2. Add it

Follow the prompts to add the Card to your digital wallet.

3. Afterpay it

Select the Afterpay Plus Card in your digital wallet and tap to pay anywhere* Apple Pay or Google Pay is accepted.

Frequently Asked Questions

The Afterpay Plus Card is a digital card that lives in your digital wallet and lets you pay in 4 interest-free installments anywhere Apple Pay or Google Pay is accepted.

Sign up for the Afterpay Plus Card in the Afterpay app. Follow the steps to add the Afterpay Plus Card to your digital wallet. When you’re ready to pay, select the Afterpay Plus Card in your digital wallet and tap to pay anywhere Apple Pay or Google Pay is accepted.

The Afterpay Plus Card will replace the Afterpay Card for all in-store purchases.

The Afterpay Plus Card can only be used for US purchases made with Apple Pay or Google Pay. Certain merchant, product, goods, and service restrictions apply.

Your available spend amount is an estimate based on your spending pattern and can go up and down as you spend. This applies to all Afterpay users to help maintain your good credit and give you confidence every time you shop. View your available spend amount on the In-Store tab.

Afterpay purchases follow the retailer's standard return policy. Check with the retailer to make sure your purchase is eligible for return.

If your item is eligible for a refund to your original form of payment, follow these steps:

- Launch the Afterpay app and tap into the Card tab.

- Select “How it Works” in the top right corner, followed by “How do I return an order?”

- Tap the “Make an Afterpay Card return” button, followed by “Refund to Afterpay Card”

- Your Afterpay Card will open in your digital wallet. Tap the phone near the card reader to initiate the return.

- If the return is successful, it may take up to 10 days for funds to be returned to your card.

LEGAL TERMS: The Afterpay Plus Card can only be used for US purchases made with Apple Pay or Google Pay. Certain merchant, product, goods, and service restrictions apply.

The Afterpay Plus Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc,. and the installment plans under the Afterpay Plus Card are issued by First Electronic Bank, Member FDIC. Click here for complete terms.

Visa® is a registered trademark of Visa U.S.A Inc. All other trademarks and service marks belong to their respective owners.