Afterpay merchant fees.

You’ve signed up to offer Afterpay to your customers. So, what now?

Partnering with Afterpay connects you to the world’s most valuable customer.

+54%

Afterpay customers spend 54% more overall^.

+28%

Their average order value is 28% higher^.

48%

would shop elsewhere if Afterpay wasn’t available.*

Before that customer makes their first purchase, it’s important to understand how Afterpay works for your business and the fees involved in offering our service to your customers.

These details are set out in your Afterpay merchant agreement, but we’ve put together this handy guide to explain:

- What to do if you need to issue a customer a refund.

- The payment process & how the fee structure works for online and in-store transactions.

- What to do if you need to issue a customer a refund.

- The payment process & how the fee structure works for online and in-store transactions.

How do Afterpay’s fees work for merchants?

As an Afterpay merchant, you are charged a fee for each Afterpay purchase made by a customer using Afterpay as their payment method (and for which Afterpay has provided you with approval confirmation).

The fee comprises a fixed fee, plus a percentage amount, and can differ depending on whether the Afterpay transaction was online or in-store (your Afterpay merchant agreement will detail this).

Online transactions.

Online transactions.

Customer makes

an online purchase.

Afterpay takes a percentage of the sale as a fee.

You are paid out the remaining transaction amount within 5 business days.

If a customer checks out online with Afterpay, we will pay you the purchase amount on behalf of the customer, setting off amounts owed to us under your Afterpay merchant agreement i.e. the fee for that transaction.

We will send the remaining balance to your nominated account, typically up to five business days following the date of the Afterpay purchase, in accordance with your Afterpay merchant agreement.

In-store transactions.

In-store transactions.

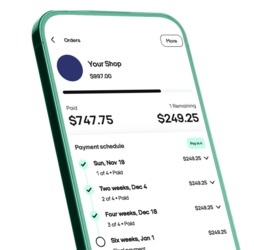

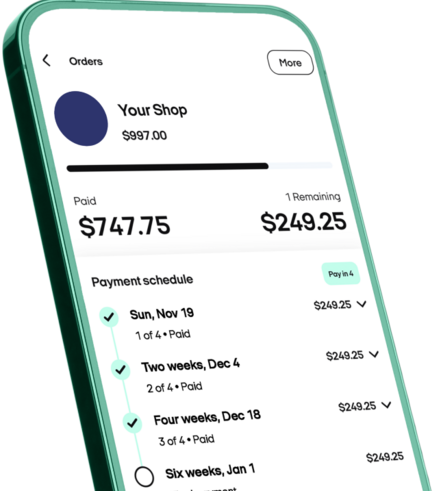

Customer makes an in-store purchase using Afterpay Card.

You receive the funds, less any processing fees, from your payment service provider.

Afterpay takes a percentage of the sale as a fee.

Afterpay direct debits amounts owed, like the fee for the transaction.

If a customer uses Afterpay to make a purchase in-store, the process is a little different. These transactions process on your payment terminal like any other eftpos transaction, meaning your payment service provider will pay you upfront for each Afterpay purchase made in-store, less any processing fees.

Afterpay will then invoice you for amounts owed, and direct debit that amount from your nominated account, typically on the second day following the invoice date, in accordance with your Afterpay merchant agreement.

For more information on Afterpay’s direct debits and how reconciliation works, visit our Merchant Help Centre.

Don’t forget, you can always keep track of all payments and orders via daily settlement reports in the Afterpay Business Hub.

Does Afterpay charge the customer at any point throughout this process?

Afterpay does not charge our customers annual fees or interest to use our BNPL product.

We may charge a late fee if a customer misses a payment. But first, we will do everything we can to help customers avoid this, including sending reminders leading up to the payment due date and an alert after a payment has failed.

As an Afterpay merchant, you are charged a fee for each Afterpay purchase made by a customer using Afterpay as their payment method (and for which Afterpay has provided you with approval confirmation). The fee comprises a fixed fee, plus a percentage amount, and can differ depending on whether the Afterpay transaction was online or in-store (your Afterpay merchant agreement will detail this).

What if I need to process a refund?

If a customer checks out with Afterpay, you can still offer them a refund, in accordance with your Afterpay merchant agreement.

To find out more about how to process a refund for online transactions, learn more here, and for in-store transactions, learn more here.

Have more questions?

You can always visit our Merchant Help Centre for more information, or reach out to us with any further questions.

^Mastercard Study: Quantifying the incremental impact of Afterpay, June 2022

*Afterpay Brand Equity Tracking, Australia and New Zealand, Wave 8, November 2023.