Your guide to Afterpay - in person and online

Offering Afterpay is simple. Here’s how to process payments using the Afterpay Card or online, issue refunds and more.

Afterpay lets your customers pay it in 4 easy payments, interest-free, over 6 weeks

Afterpay lets

your customers

pay it in 4 easy

payments,

interest-free, over

6 weeks

The best part? Your business benefits too, with more sales, more customers and bigger basket sizes.

As a business owner, you can offer Afterpay both in person and online.

How Afterpay works

in person

It's simple to accept in-person payments using the Afterpay Card.

You process the payment like you would with any other contactless transaction, and your customers taps the Afterpay Card from their mobile to complete the purchase.

It's simple to accept in-person payments using the Afterpay Card.

You process the payment like you would with any other contactless transaction, and your customers taps the Afterpay Card from their mobile to complete the purchase.

HOW DOES THE AFTERPAY CARD WORK?

how afterpay works for customers

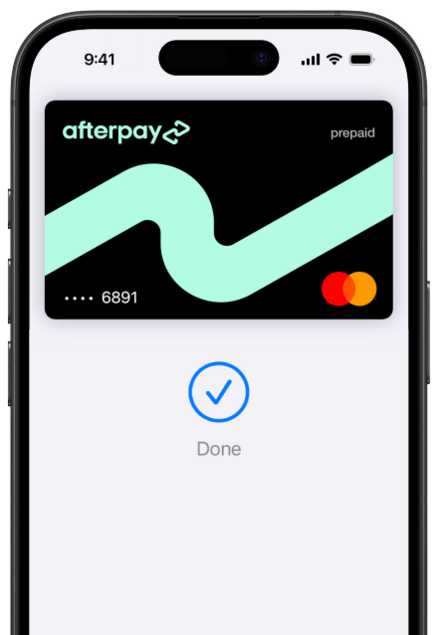

The Afterpay Card is the in-person Afterpay solution and it works just like any other digital card. Customers add the Afterpay Card to their digital wallet on their phone via a one-time setup process, prompted in their Afterpay app. Then, simply tap their Afterpay Card to pay. Processing Afterpay Card payments are easy, just follow these four steps:

STEP 1

You process the transaction like any other card payment on your point-of-sale (POS).

STEP 2

Your customer taps their Afterpay Card (from their phone) on your payment terminal to pay.

STEP 3

That’s it. You’re paid upfront by Afterpay, while your customer pays it in 4 interest-free instalments.

TIP:

Because you receive the full sale amount upfront (even if your customers pay in instalments), it’s important that you process the full sale amount through your POS system.

STEP 4

Afterpay will direct debit your business the Afterpay fee owned for the transaction within 3 business days.

TIP:

You can log in to Afterpay Business Hub to keep track of Afterpay orders and payments at any time.

The Afterpay Card is powered by Mastercard in Australia and by Visa in New Zealand

WANT TO LEARN MORE ABOUT AFTERPAY?

take me back to the education hub

Working in a customer-facing role and looking for a printable version of the Afterpay Guide for in-person payments?

How Afterpay works

online

It's easy to accept online payments using Afterpay. When customers purchase online, they select Afterpay as the payment option at checkout, just as they would with any other card payment.

How online payments work for Afterpay merchants

How online

payments

work for Afterpay

merchants

Online payments with Afterpay are easy, following these four steps:

STEP 1

Your customer adds items from your website to their cart and selects Afterpay at checkout.

STEP 2

They're then redirected to log in to their Afterpay account to complete and approve the purchase.

STEP 3

You get paid the full amount by Afterpay (typically within five business days), while your customer pays in 4 interest-free instalments.

STEP 4

You can track all Afterpay orders and payments at any time in the Afterpay Business Hub.

FAQs for Afterpay transactions

Available spend limit is too low

Every customer has an individual available spend limit. For new customers, it might start at a few hundred dollars and can increase anywhere up to $4000. The limit only increases with responsible spending, meaning the customers paying on time. Customers can check their limit within the Afterpay app.

Linked payment method is incorrect

The customer needs to ensure that their linked payment method in their Afterpay account is current and correct (with a minimum of three months before expiry.) If not, they can add another card.

Overdue balance

Customers must ensure they don’t have any overdue Afterpay payments. (They can resolve this on the spot via their app if needed.)

Does your customer need help? They can contact Afterpay’s customer service team via the help section of the Afterpay app or by filling out this form online.

What is the maximum amount a customer can purchase using Afterpay?

This varies, depending on factors such as spending habits and repayment history. The customer can view their pre-approved, available-to-spend limit on the ‘In-Store’ tab in their Afterpay App or by logging into the Afterpay website.

Your business may have a minimum or maximum purchase amount for Afterpay. Make sure you check your internal policy.

You and your team can contact our friendly Business Support team via phone:

AUSTRALIA 1300 621 603 09:00-17:00 AEST/AEDT

NEW ZEALAND 0800 472 317 11:00-19:00 NZST/NZDT

Additionally, visit help.business.afterpay.com anytime to access helpful FAQs & troubleshooting tips.

If your customers need support? They can contact our Customer Service team via the 'Help' button within their Afterpay app.

View more

AFTERPAY IN PERSON

How do I process an in-person refund?

It’s simple. You process Afterpay refunds the same way as you’d normally process a card refund.

- Confirm the original purchase was made with Afterpay (see the below instructions under "How can I check that the customer originally paid with the Afterpay Card").

- Process the refund through your POS system as you normally would, following your business’ returns policy. Be sure to refund the full amount (regardless of how many payments the customer has made to Afterpay).

- Once this prompts your eftpos terminal, the customer taps their Afterpay Card to complete the refund.

- That’s it. The customer will receive the refund within a few business days, and any remaining payments will be cancelled. Your refund will be reflected in your next settlement.

When will I receive funds?

You receive the funds at the time of purchase via your service provider, less any processing fees. Afterpay then takes a percentage of the sale as a fee which will be direct debited from your nominated bank account.

How can I check that the customer originally paid with the Afterpay Card?

Your customer’s receipt will show the payment method as Mastercard in Australia and Visa in New Zealand. You can then match the last four card digits listed on the receipt to the Afterpay Card device number via the steps below. This is the same process you would use to match any digital card number to the receipt.

Apple devices

- Open the Wallet app and tap the Afterpay Card.

- Click the three dots followed by the Apple Card Number.

- Find the four digits listed under Apple Pay.

Android devices

- Open the Google/Samsung Wallet and tap the Afterpay Card.

- Tap the three dots to find the four digits listed under ‘Virtual account number.’

What if the customer accidentally provides a different payment method for the return?

Does your customer need help? They can contact Afterpay’s customer service team via the help section of the Afterpay app or by filling out this form online.

What about partial refunds?

If there is a partial refund applicable, process the return in the same way as outlined above under "How do I process an in-person refund?”

Can I process an online refund in-person?

If your business accepts refunds for online orders in person, you process the refund or exchange as you normally would.

What about exchanges?

If your policy allows it, initiate the exchange via your POS following your usual process. Then, if there is a partial refund applicable, process the return in the same way as outlined above. However, if the customer owes a difference in cost, process the remainder of the sale in the same way as your usual sales process, via any tender type.

What happens when customers don’t have the Afterpay Card?

Customers need the Afterpay Card to purchase in person. To get the Afterpay Card, they simply download the Afterpay app from their device’s app store.

You and your team can contact our friendly Business Support team via phone:

AUSTRALIA 1300 621 603 09:00-17:00 AEST/AEDT

NEW ZEALAND 0800 472 317 11:00-19:00 NZST/NZDT

Additionally, visit help.business.afterpay.com anytime to access helpful FAQs & troubleshooting tips.

If your customers need support? They can contact our Customer Service team via the 'Help' button within their Afterpay app.

View more

AFTERPAY ONLINE

What happens if a customer doesn’t receive their order?

They will either contact you directly or they will raise a dispute in their Afterpay account. You can review the dispute case and respond directly within the Afterpay Business Hub.

When will I receive funds?

As an Afterpay merchant, you’ll be assigned a settlement period between one to five business days. This will be in your agreement with us.

How do I refund an online order?

It's easy. Simply follow the below steps:

- Log in to Afterpay Business Hub

- Click on 'Orders'

- Locate the relevant order and press the 'Refund' button

- Enter the refund amount and your Business Hub password to complete the refund.

- The refund will be processed by Afterpay

- Afterpay will credit your account for the amount returned at the next settlement date, less merchant fees.

Note:

- Once a refund has been issued, Afterpay is not able to reverse or change this action.

- If the customer has made payments to Afterpay already, they will be refunded

Using any of the below e-commerce platforms?

All refunds must be processed via your own platform and not the Afterpay Business Hub.

- Shopify

- WooCommerce

- BigCommerce

- Magento

- Prestashop

Do I process the return via my e-commerce platform or through Afterpay’s Business Hub?

Some platforms, such as Shopify, WooCommerce, BigCommerce, Magento and Prestashop, must process refunds via their own platforms.

Not on one of these platforms?

- Log in to Afterpay Business Hub

- Click on 'Orders'

- Locate the relevant order and press the 'Refund' button

- Enter the refund amount and your Business Hub password to complete the refund.

- The refund will be processed by Afterpay

- Afterpay will credit your account for the amount returned at the next settlement date, less merchant fees.

View more

Level up your Afterpay business experience

Looking for more tips and tricks on your Afterpay merchant experience? Check out our Merchant Education Hub for video walkthroughs on completing an in-person or online payment, how to get free visual merchandising for your business and more!