Discover why Australia’s biggest brands choose Afterpay

Whether your customers are foodies or fashion lovers, tourists or techies, Afterpay offers them a flexible way to pay. Even better? It boosts your business, too.

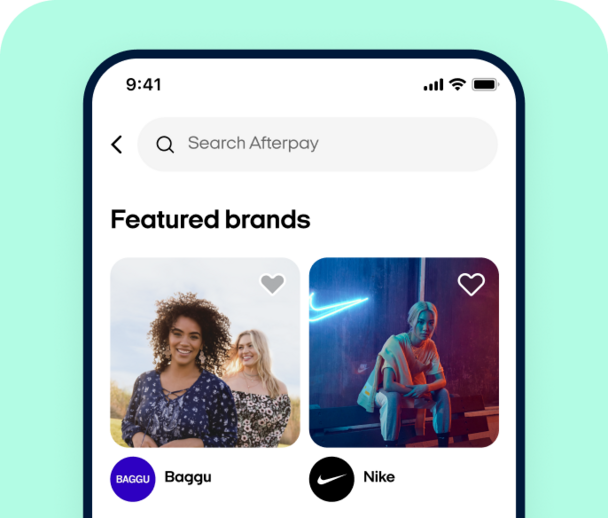

Afterpay is proud to partner with a wide range of brands

since adopting afterpay...

since adopting AFTERPAY

of Afterpay merchants reported exposure to new customers.1

of Afterpay merchants reported an increase in repeat purchases.1

37%

of Afterpay merchants reported a larger customer basket size.1

Tap into

4.4 million

customers in

Australia and

New Zealand.2

Tap into 4.4 million customers in Australia and New Zealand.4

Tap into

4.4 million

customers in

Australia and

New Zealand.2

- Simple sign-up

- Easy integration

- Transparent pricing

How Afterpay works for businesses

step 1

step 1

Your customers check out with Afterpay and split their purchases into 4 instalments over 6 weeks.

step 2

step 2

Your business receives the full purchase amount, within 5 business days.

step 3

step 3

Afterpay charges your business a fee for each transaction. (You can keep track of all payments and orders in the Afterpay Business Hub.)

what other brands say about afterpay

CITY PERFUME

City Perfume offers fragrances and beauty products from its three stores and thriving online business.

30%

increase in sales

1 in 4

10%

customers pays with Afterpay

11k

referrals to City Perfume from Afterpay Shop Directory

bailey nelson

Bailey Nelson offers affordable, friendly eyewear - with the option to pay with Afterpay at any Bailey Nelson store.

41%

sales uplift during Afterpay Day

10%

Bigger basket size with Afterpay

16k

referrals to Bailey Nelson from Afterpay Shop Directory

All stats provided by brands.

Afterpay helps your team drive business growth

Increase incremental sales

Afterpay merchants generated $9.6 billion in incremental sales in 2023, thanks to larger basket sizes, new customers and more repeat purchases1. Meanwhile, 48% of Afterpay consumers will shop elsewhere if Afterpay isn’t available4.

drive brand loyalty

By offering a flexible way to pay, Afterpay enhances customer experience and drives brand loyalty. More than half (53%) of Afterpay merchants experience an increase in repeat purchases1.

Future-proof your business

With a customer base comprised of two-thirds Gen Z and Millennials3, Afterpay helps your business reach next-generation shoppers.

Increase incremental sales

Afterpay merchants generated $9.6 billion in incremental sales in 2023, thanks to larger basket sizes, new customers and more repeat purchases1. Meanwhile, 48% of Afterpay consumers will shop elsewhere if Afterpay isn’t available4.

drive brand loyalty

By offering a flexible way to pay, Afterpay enhances customer experience and drives brand loyalty. More than half (53%) of Afterpay merchants experience an increase in repeat purchases1.

Future-proof your business

With a customer base comprised of two-thirds Gen Z and Millennials3, Afterpay helps your business reach next-generation shoppers.

Attract more customers

Two-thirds of Afterpay merchants report exposure to new customers since adopting Afterpay1, while Afterpay Shop Directory acts as a new marketing channel, driving one million referrals, globally, every day5.

Capture new audiences

With a customer base comprised of 64% Gen Z and Millennials6, Afterpay helps your business reach next-generation shoppers.

Drive brand trust

Afterpay is Australia’s most popular Buy Now Pay Later platform, trusted by one in three Australians3.

Attract more customers

Two-thirds of Afterpay merchants report exposure to new customers since adopting Afterpay1, while Afterpay Shop Directory acts as a new marketing channel, driving one million referrals, globally, every day5.

Capture new audiences

With a customer base comprised of 64% Gen Z and Millennials6, Afterpay helps your business reach next-generation shoppers.

Drive brand trust

Afterpay is Australia’s most popular Buy Now Pay Later platform, trusted by one in three Australians3.

FOR

e-commerce directors:

increase basket size

Boost basket size by enabling customers to pay in instalments. More than a third (37%) of Afterpay merchants reported a larger customer basket size since adopting Afterpay1.

Enhance online experience

Cut cart abandonment and improve customer experience by offering Afterpay, which enables shoppers to purchase what they want, when they want it, and pay over time.

Access a powerful new marketing channel

Afterpay Shop Directory acts as a new marketing channel, driving one million referrals to businesses, globally, every day.

increase basket size

Boost basket size by enabling customers to pay in instalments. More than a third (37%) of Afterpay merchants reported a larger customer basket size since adopting Afterpay1.

Enhance online experience

Cut cart abandonment and improve customer experience by offering Afterpay, which enables shoppers to purchase what they want, when they want it, and pay over time.

Access a powerful new marketing channel

Afterpay Shop Directory acts as a new marketing channel, driving one million referrals to businesses, globally, every day.

FOR

finance directors:

Drive sales growth

Afterpay boosts sales by delivering larger basket sizes, more customers and more repeat purchases1. Meanwhile, 48% of Afterpay consumers will shop elsewhere if Afterpay isn’t available7.

Boost cashflow

Afterpay enables customers to purchase what they want, when they want it, while paying over time. However, merchants are paid upfront.

reduce risk

Afterpay takes on all non-payment risk, meaning merchants don’t need to chase payments. Afterpay also offers fraud protection and handles all disputes.

Drive sales growth

Afterpay boosts sales by delivering larger basket sizes, more customers and more repeat purchases1. Meanwhile, 48% of Afterpay consumers will shop elsewhere if Afterpay isn’t available7.

Boost cashflow

Afterpay enables customers to purchase what they want, when they want it, while paying over time. However, merchants are paid upfront.

reduce risk

Afterpay takes on all non-payment risk, meaning merchants don’t need to chase payments. Afterpay also offers fraud protection and handles all disputes.

New report

The future of payments: Discover how Gen Z shops and spends

Want to know how tomorrow’s customers will pay? Morning Consult asked 4,300 Australian adults to find out how they manage their spending and payments. The bottom line? Gen Z is shifting away from credit cards and embracing BNPL.

Getting started with Afterpay has never been easier.

1Afterpay’s economic impact in Australia report

2Afterpay internal data March 2025

3Afterpay internal data June 2024

4Afterpay Brand Equity Tracking, Australia and New Zealand, Wave 8, November 2023

5Afterpay internal data, 2021

6Brand Health Wave 9, Afterpay, June 2024

7Afterpay internal data, November 2023