Shopping with Clearpay?

Marketing

resources

Here you’ll find everything you need to make the most of our partnership.

Let your customers know Afterpay is available

Offering Afterpay and want to let your customers know? A great way to do this is to include an ‘About Afterpay’ page on your website which lets customers know Afterpay is available and answers their most frequently asked questions.

To make it easy, we’ve created some templated copy you can use, as well as some banners you can include at the top of the page. Please include any sections you feel are relevant to your audience. We ask that you do not change the wording, as this messaging is compliant with Afterpay’s marketing and advertising guidelines.

Important:

At the bottom of each page, you MUST include the following disclaimer:

Late fees, eligibility criteria and T&Cs apply. Afterpay Australia Pty Ltd Australian Credit Licence 527911.

We’ve provided you with three options that you can use at the top of the page to let customers know Afterpay is now available

OPTION 1

Shop now, pay it in 4 with Afterpay.

At <Brand name>, you can buy now and pay it in 4 interest-free instalments over 6 weeks.

OPTION 2

Pay it in 4 with Afterpay.

Checkout with Afterpay. Get what you want now and pay it in 4 instalments over 6 weeks, interest-free!

OPTION 3

S6 weeks to pay, zero interest.

At <Brand name>, you can buy now and split the payments into 4 interest-free instalments over 6 weeks.

Afterpay is a buy now, pay later platform that lets you pay for your items in 4 instalments over 6 weeks, interest free.

Why use Afterpay with <Brand name>?

Easy to apply.

Simple and easy to join. Set up an account in minutes. Credit checks apply.

Spend limits are dynamic and start low.

Once approved, enjoy your dynamic spending limit. We start new customers at a lower spend limit and may increase it gradually over time.

Accepted <in-store and online>|<online>

Once approved, you can pay it in 4 whenever you shop with

It’s easy to manage your account inthe app.

Track your payments, check available spend limits, and make early payments in theAfterpay App.

When you use Afterpay, you pay for your items in 4 instalments over 6 weeks, without incurring any interest. To use Afterpay, add items to your shopping cart then select Afterpay from the available payment options. You pay for the first instalment of 25% at the time of purchase, and the remaining three instalments will be automatically deducted from your nominated debit or credit card over the following six weeks.

Step one: Add your items to your shopping cart.

Step two: Select Afterpay as your payment method at the checkout.

Step three: You’ll be redirected to Afterpay to login or create your account.

Step four: Your payment schedule will be displayed.

Step five: Track your payments, check available spend limits, and make early payments in the Afterpay app.

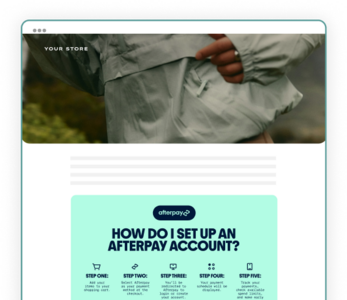

Prefer this as a visual?

Download our pre-made step-by-step image and add to your page

To set up an Afterpay account you’ll need to:

Live in Australia or New Zealand

Be over 18 years of age

Have an Australian/New Zealand debit or credit card

Have a valid and verifiable email address and mobile number

Have a valid and verifiable email address and mobile number

Be capable of entering into a legally binding contract

Credit checks apply

For full terms and conditions visit www.afterpay.com/terms.

Afterpay caps late fees to help keep costs manageable for customers who miss a payment. Late fees will never exceed 25% of the order total or $68 per order, whichever is lower.

How this works:

For orders under $40: A one-time late fee of up to 25% of the order total applies

For orders of $40 or more: A $10 late fee is charged when a payment is missed. If the outstanding amount remains unpaid after seven days, an additional $7 late fee applies . This is the same for all late payments until the 25% cap or $68 amount is reached. To remain within the cap, we may charge partial amounts of the $10 and $7 fees.

You can check your General Terms for other late fees caps that may apply.

Afterpay is committed to doing everything they can to help you not miss a payment, including sending you payment reminders and offering options to reschedule upcoming payment dates.

Afterpay is designed to be completely different to traditional credit products that charge interest, so that customers are never in a situation of high compounding interest and revolving debt.

Afterpay can be used online and in stores, depending on the retailer or service. To shop in-store, you’ll need to download the Afterpay app and set up the Afterpay Card. You can add it to your digital wallet via the ‘In-store tab’ in the app. Then when you’re shopping in-store, just tap to pay with Apple Pay, Google Pay or Samsung Pay. To shop online, select Afterpay as your payment method at the checkout. You’ll be redirected to Afterpay to login or create your account.

Afterpay has been built with a range of security features and services to help keep your accounts secure, including monitoring transactions to identify fraudulent trends and behaviours, multi-factor authentication, and encryption to protect your information. You can find out more on at Afterpay’s safety and security page.

Items purchased with Afterpay can be returned for an exchange or refund, subject to ’s Returns Policy. Returns or refunds will be processed and Afterpay will be advised. Your payment plan will then be adjusted to reflect the new total order value. If you have already made a payment, this will be refunded to you via Afterpay.

To find out more, visit the Afterpay website.

Previous page

Vertical assets

Next page

Email assets