Get more out of Afterpay.

Make Afterpay work for you. Find out how to level-up your Afterpay experience.

Enhance

your Afterpay

experience.

Be the boss of your payments with our latest features. Watch our video to find out more, plus hear about credit checks and reporting being introduced from 23 July 2024 as part of our industry obligations.

Start with the basics.

Pay it in 4. In-store.

Enjoy all the perks of Afterpay in-person. Add the digital Afterpay Card to your phone’s wallet via the app, shop in-store then pay over 6 weeks.

Set up now

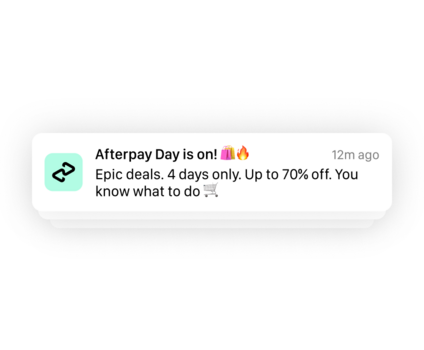

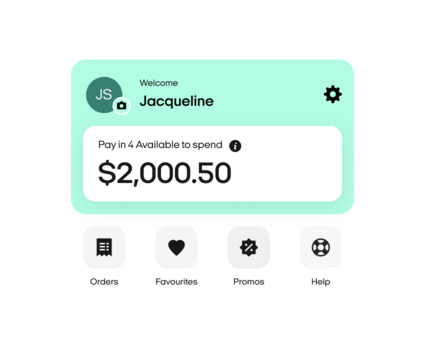

Catch a deal with the app.

Use the Afterpay app to find the best deals and exclusive offers from top brands. Turn on your notifications so you don’t miss a thing.

Save it. Label it. Plan it.

Tap the heart to save, list and organise all your favourite products. Plan a budget before you check out by tapping $ and get a breakdown of the payments due.

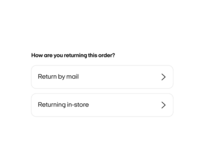

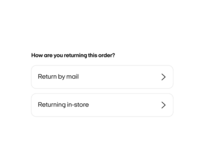

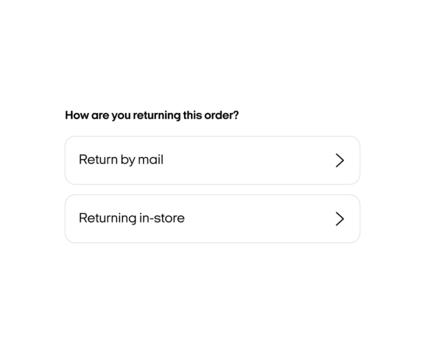

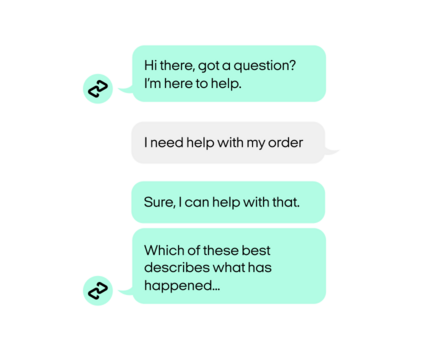

Don’t sweat the returns.

Start your return directly with the store, then once the store notifies us, we’ll refund you, starting with your final payment and working backwards. Log your return in the app to pause any future payments.

Find out more

Manage your money with confidence.

Keep tabs on your orders & payments.

Check your spend limit and orders in the My Afterpay tab. Stay on top of payments by turning on notifications so we can send you reminders.

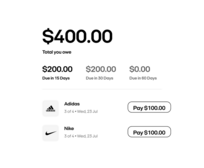

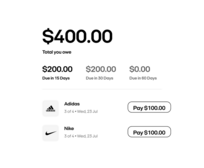

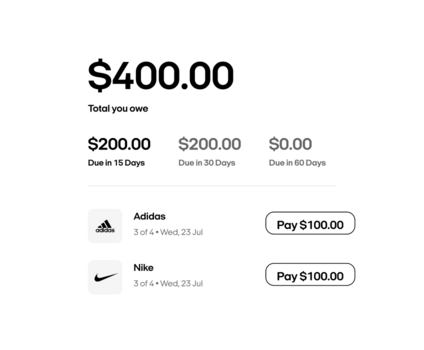

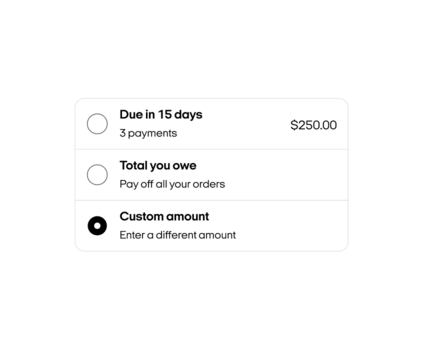

Make multiple payments with one tap.

You can choose to pay early, pay multiple orders at once, or pay the entire remaining balance.

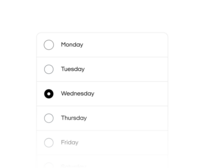

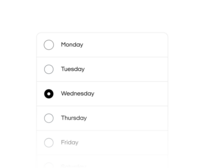

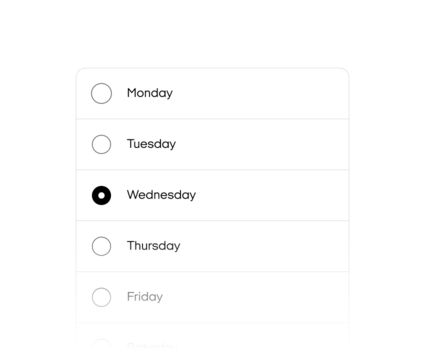

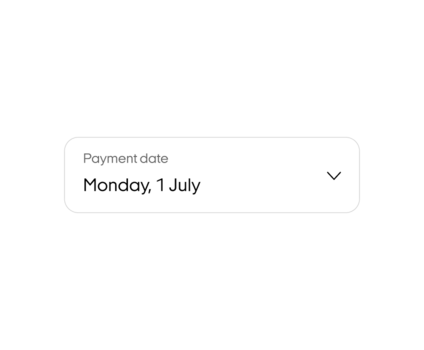

Fit payments to your schedule.

Schedule your payments to a day of the week that suits you. Pick your day in Payment settings in the app. Applies to future orders only.

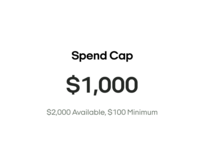

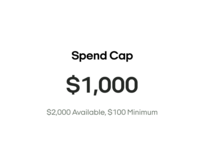

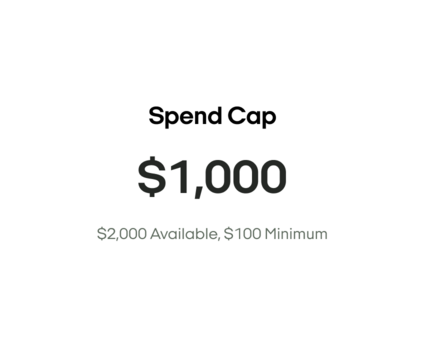

Set a spend cap with a few simple taps in the My Afterpay tab.

It's another way to manage your spending, while maintaining your approved limit for a rainy day.

Wiggle room when you need it.

Reschedule your next payment by a week if you need; you can do this up to three times a year. It’s important to note that some payments can’t be changed though.

Find out more

Need help to keep up?

We’re here to help. If you’re experiencing financial hardship, you should contact us as soon as possible to discuss your options.

Find out more

More perks.

Been with us for a while and have a good track record of consistent on-time payments?

Then these benefits are for you.

Been with us for a while and have a good track record of consistent on-time payments? Then these benefits are for you.

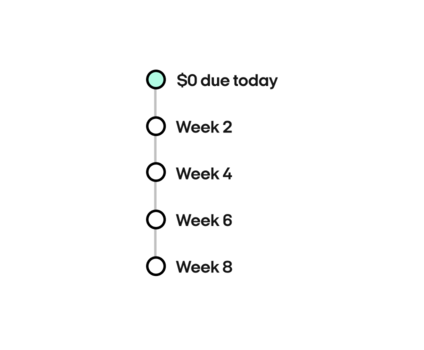

Get more time to pay.

Delay your first payment by up to two weeks with our ‘no payment upfront’ feature. That’s right, pay $0 upfront on eligible purchases under $500, excluding gift cards, and purchases at grocery merchants. Access is dependent on a range of factors - we’ll notify you if you’re eligible.

The gift of choice. The luxury of time.

Eligible customers can pay it in 4 across a wide range of gift cards delivered straight to their inbox.#

Find out more

Increase your spend limit.

Are you an Afterpay fan? Share the love.^

Late fees, eligibility criteria and T&Cs apply. See afterpay.com for full terms.

#Retailer terms, Merchant & Product exclusions apply.

See prezzee.co.nz/policies/terms-of-service/

^Invite a Friend terms apply.

Still have questions?

Do I have to download the Afterpay app to use Afterpay in-store?

Is there a minimum spend for in-store Afterpay purchases? Is there a maximum spend?

What are the benefits of choosing a payment day?

If I change my mind, can I cancel my preferred payment day?

Is there a limit on changing my preferred payment day?

What is ‘no payment upfront’ and how does it work?

Received a notification at the checkout that there’s $0 due on the purchase date? Congratulations! This means that you have access to our ‘no payment upfront’ feature.

Your first payment will be due 8–14 days after your purchase date, aligned to your preferred payment day.

Access is determined by a range of factors including payment history, shopping frequency and how long you’ve been with Afterpay.

Certain purchases don’t qualify for ‘no payment upfront:

- Gift cards

- Orders over $500

I no longer have access to the ‘no payment upfront’ feature - why?

If you previously had access to the ‘no payment upfront’ feature and have missed some payments on your account, or haven’t used Afterpay in a while, this will result in the feature being deactivated. We may also deactivate the feature in accordance with the Afterpay Terms of Service.

The good news? We review access regularly. Keep using Afterpay, stay on top of your payments and we might have good news for you soon. Be sure to have your app updated and your notifications enabled.

Can I reschedule a payment on an existing order?

Yes, you can reschedule your next payment by a week. You can do this up to three times a year. Simply select the payment that you wish to change, tap More in the top right of your screen, and then select “Change next payment date”.

Some payments cannot be changed. If the option is not available, you will see a message on screen that says "Uh oh! This payment date can’t be changed"

Reasons why:

- You can only move one payment per order. If you need more help, please send us a message via the app.

- You will not be able to reschedule the first or last payments via this self-service feature, if you require help with this, please send us a message via the app.

- If a payment is already overdue or due within the next 24 hours, we cannot move the payment (neither our team or by using the self-service feature).

- Brand new customers (less than 42 days since your first purchase) will not be able to use this feature.

- If you are already under a hardship repayment arrangement with us, you will not have access to this feature.

I’ve already used up my 3 self-service reschedules for the year, but need to move more, what can I do?

Can I buy gift cards from Afterpay?

Eligible customers can purchase e-gift cards from a variety of leading retailers. To see if you are eligible, go to the Afterpay app and see if you have ‘gift cards’ available..

Don’t see gift cards? Or don’t see the options you were looking for?

The purchase of gift cards is restricted for some customers. We make a determination based on your shopping history with us. We take into consideration things like how long you have been a customer with us and how consistent you have been with making on-time payments. This may mean you are able to buy gift cards from a certain store one week and then the next week you see a range of different options available and some stores may be missing.

Good to know: The better your history with us, the more options you will have to purchase gift cards.

Why is my purchase of gift cards declining?

As with all Afterpay purchases, we make a decision to approve or decline the purchase immediately. This decision is completely managed by Afterpay, not Prezzee.

There are a few different reasons as to why your purchase could be declining; it could be that you have more than one gift card outstanding with us, or if you’re a new customer, there are maximum amounts you can purchase with us. It is also important to note that we do not approve 100% of purchase attempts; many factors are at play including fraud prevention.

It may help to wait a while, or pay off the balance of any outstanding orders before attempting to try again.

How can I increase my spend limit?

The short answer is that we cannot manually increase your available spend limit, as your limit is automatically determined based on a range of different factors.

Here are a few of the key factors that we take into consideration when determining your limit:

- On-time payment history.

- How long you’ve been with Afterpay.

- Any declined orders or payments.

- The information contained in your credit report.

What is a credit check?

Credit checks are when lenders make an enquiry to a credit reporting bureau to obtain a customer’s credit report. It is a summary of your credit history and helps businesses to assess risk and make informed decisions about things like lending or offering services.

At Afterpay, we conduct credit checks to evaluate new customers' applications and to determine if a spend limit increase is appropriate. These checks help us make informed decisions while ensuring responsible lending practices.

The credit check we perform when you join may be visible to other lenders and may impact your credit score.

In contrast, the credit checks we perform during spend limit increase assessments are not visible to other lenders and do not impact your credit score.

Why does Afterpay perform credit checks?

Afterpay performs credit checks to comply with New Zealand's laws and regulations. It’s one of the factors we take into consideration when assessing your application to join Afterpay. Credit checks help us ensure that your spending limits are suitable for your circumstances. It's part of our commitment to being a responsible lending partner and to help maintain a transparent and fair credit system.

We perform credit checks at sign-up for new customers. This enquiry may be visible to other credit providers and may impact your credit score.

We also perform credit checks when considering you for a higher spend limit. These checks will not be visible to other credit providers and will not impact your credit score.

We’ll collect your consent before we conduct any checks. You will only need to consent to these checks once, and we handle the rest with utmost confidentiality and care.

If you require further help, please get in touch via the app.

What is a credit report?

A credit report is a detailed record of your credit history, including loans, credit accounts, and how you've managed them. Lenders may use this report to gauge how reliable you are when it comes to managing credit. Credit bureaus build your report from data shared by lenders and financial institutions. It's a collective snapshot of your credit activities.

For detailed information, head to the Centrix website.

In New Zealand, we report credit activities to bureaus to help maintain an accurate record of your credit history.

Your credit report is about you, but it's owned by the credit bureau. You have the right to access it and correct any mistakes. Understanding your credit report can help you make better financial decisions. It's also important to ensure the information is correct, so you're fairly represented to lenders.

You have the right to access your credit report free of charge every 3 months. To request your report, please contact Centrix directly. It's crucial to ensure that your credit information is accurate.

If you find discrepancies or have any disputes regarding your credit report, please reach out to Centrix using the contact details below:

Website: centrix.co.nz

Email: [email protected]

Phone: 0800 836 274

Mail: PO Box 62512, Greenlane, Auckland 1546

We're here to help. If you have any concerns or wish to submit a complaint about Afterpay's process, please get in touch via help in the app.

What if I don’t consent to performing credit checks and credit reporting? Will I still be able to use Afterpay?

What information is being reported to credit bureaus?

Under NZ regulations Afterpay is required to report credit information to credit bureaus. This includes the good (when you’re up-to-date with your payments) and the not-so-good (when you are late on your payments).

It's important to understand that late payments may have a negative impact on your credit score. However, Afterpay also reports positive payment information, so consistently making payments on time could be a way to contribute to a positive credit history.

If you cannot make a payment on time, you can reschedule your next payment by a week, up to 3 times a year, in the Afterpay app. If you’re facing financial difficulties, we encourage you to reach out to Afterpay's customer service team via the app as soon as possible. We have policies in place to support customers experiencing financial hardship, and we may be able to assist you with rescheduling payments or other measures to help you get back on track.

What is a credit score?

A credit score is a numerical expression that tells lenders how good you are at borrowing money and paying it back. It's a number that goes up and down based on how well you handle your money - like if you pay your bills on time or if you owe a lot of money to different places.

If you have a high credit score, banks and lenders are more likely to think you're good at managing your money, which can make it easier for you to borrow money for things like a car or a house, and sometimes at a better interest rate.

If I have a bad credit score, will I still be able to use Afterpay?

When you apply to join Afterpay, we consider a variety of factors — including information from your credit report — to assess whether an account is right for you.

Having a low credit score, or no credit history at all, won’t automatically prevent you from being approved. Similarly, having a great credit score doesn’t guarantee approval either. We assess each application carefully, based on a combination of factors.

If you already have an account and become eligible for a higher spend limit, we may perform a credit check as part of that assessment. We’ll always ask for your consent before we do. A lower credit score won’t necessarily mean a lower spend limit, just as a higher score doesn’t guarantee an increase.

If a spend limit increase isn’t right for you at the time we assess your eligibility, your existing spend limit won’t change. However, please note that missing payments or changes in your account activity may result in a lower spend limit.

How can I contact Afterpay?

Most questions can be answered quickly by browsing our Help articles, so we recommend starting there for the fastest solution. If you still need help, you can receive 24*7 digital support by messaging us us through the Help section of your Afterpay app. If you don't have the app, you can complete a contact form here.

If you prefer phone support, you can request a callback from our team. Simply message us through the Help section of your Afterpay app and let us know you’d like to speak with someone over the phone. Your request will be sent to our dedicated phone support team, who will call you back during our phone support hours.

Do I have to download the Afterpay app to use Afterpay in-store?

Is there a minimum spend for in-store Afterpay purchases? Is there a maximum spend?

What are the benefits of choosing a payment day?

If I change my mind, can I cancel my preferred payment day?

Is there a limit on changing my preferred payment day?

What is ‘no payment upfront’ and how does it work?

Received a notification at the checkout that there’s $0 due on the purchase date? Congratulations! This means that you have access to our ‘no payment upfront’ feature.

Your first payment will be due 8–14 days after your purchase date, aligned to your preferred payment day.

Access is determined by a range of factors including payment history, shopping frequency and how long you’ve been with Afterpay.

Certain purchases don’t qualify for ‘no payment upfront:

- Gift cards

- Orders over $500

I’ve already used up my 3 self-service reschedules for the year, but need to move more, what can I do?

Can I reschedule a payment on an existing order?

Yes, you can reschedule your next payment by a week. You can do this up to three times a year. Simply select the payment that you wish to change, tap More in the top right of your screen, and then select “Change next payment date”.

Some payments cannot be changed. If the option is not available, you will see a message on screen that says "Uh oh! This payment date can’t be changed"

Reasons why:

- You can only move one payment per order. If you need more help, please send us a message via the app.

- You will not be able to reschedule the first or last payments via this self-service feature, if you require help with this, please send us a message via the app.

- If a payment is already overdue or due within the next 24 hours, we cannot move the payment (neither our team or by using the self-service feature).

- Brand new customers (less than 42 days since your first purchase) will not be able to use this feature.

- If you are already under a hardship repayment arrangement with us, you will not have access to this feature.

I no longer have access to the ‘No payment upfront’ feature - why?

Can I buy gift cards from Afterpay?

Eligible customers can purchase e-gift cards from a variety of leading retailers. To see if you are eligible, go to the Afterpay app and see if you have ‘gift cards’ available..

Don’t see gift cards? Or don’t see the options you were looking for?

The purchase of gift cards is restricted for some customers. We make a determination based on your shopping history with us. We take into consideration things like how long you have been a customer with us and how consistent you have been with making on-time payments. This may mean you are able to buy gift cards from a certain store one week and then the next week you see a range of different options available and some stores may be missing.

Good to know: The better your history with us, the more options you will have to purchase gift cards.

Why does Afterpay perform credit checks?

How can I increase my spend limit?

The short answer is that we cannot manually increase your available spend limit, as your limit is automatically determined based on a range of different factors.

Here are a few of the key factors that we take into consideration when determining your limit:

- On-time payment history.

- How long you’ve been with Afterpay.

- Any declined orders or payments.

- The information contained in your credit report.

What information is being reported to credit bureaus?

Why does Afterpay perform credit checks?

Afterpay performs credit checks to comply with New Zealand's laws and regulations. It’s one of the factors we take into consideration when assessing your application to join Afterpay. Credit checks help us ensure that your spending limits are suitable for your circumstances. It's part of our commitment to being a responsible lending partner and to help maintain a transparent and fair credit system.

We perform credit checks at sign-up for new customers. This enquiry may be visible to other credit providers and may impact your credit score.

We also perform credit checks when considering you for a higher spend limit. These checks will not be visible to other credit providers and will not impact your credit score.

We’ll collect your consent before we conduct any checks. You will only need to consent to these checks once, and we handle the rest with utmost confidentiality and care.

If you require further help, please get in touch via the app.

If I have a bad credit score, will I be allowed to use Afterpay?

- Website: centrix.co.nz

- Email: [email protected]

- Phone: 0800 836 274

- Mail: PO Box 62512, Greenlane, Auckland 1546

What if I don’t consent to performing credit checks and credit reporting? Will I still be able to use Afterpay?

Can I buy Gift cards from Afterpay?

What is a credit score?

A credit score is a numerical expression that tells lenders how good you are at borrowing money and paying it back. It's a number that goes up and down based on how well you handle your money - like if you pay your bills on time or if you owe a lot of money to different places.

If you have a high credit score, banks and lenders are more likely to think you're good at managing your money, which can make it easier for you to borrow money for things like a car or a house, and sometimes at a better interest rate.

Can I buy Gift cards from Afterpay?

How can I contact Afterpay?

Most questions can be answered quickly by browsing our Help articles, so we recommend starting there for the fastest solution. If you still need help, you can receive 24*7 digital support by messaging us us through the Help section of your Afterpay app. If you don't have the app, you can complete a contact form here.

If you prefer phone support, you can request a callback from our team. Simply message us through the Help section of your Afterpay app and let us know you’d like to speak with someone over the phone. Your request will be sent to our dedicated phone support team, who will call you back during our phone support hours.

Want to know more?

Check out our How Afterpay Works page, or head to our Help centre.